Are coworking spaces more than cheap offices?

Anjali Oberoi | The emergence of coworking spaces might be the most dramatic manifestation of the way our work culture is evolving. Two decades ago, you could find small businesses sharing an office space. But these occurrences generally reflected temporary cost-saving arrangements, and were noted as rarities.

Since then, the shared-economy movement has shaken up the globe and coworking has become an industry of its own. It was recently reported that shared workspaces have been growing at a yearly rate of 20% in global cities, thus doubling every three years. WeWork, the emerging leader in the field, was recently valued at $20 billion. To put things in perspective, that’s almost double the valuation of Pinterest or SpaceX.

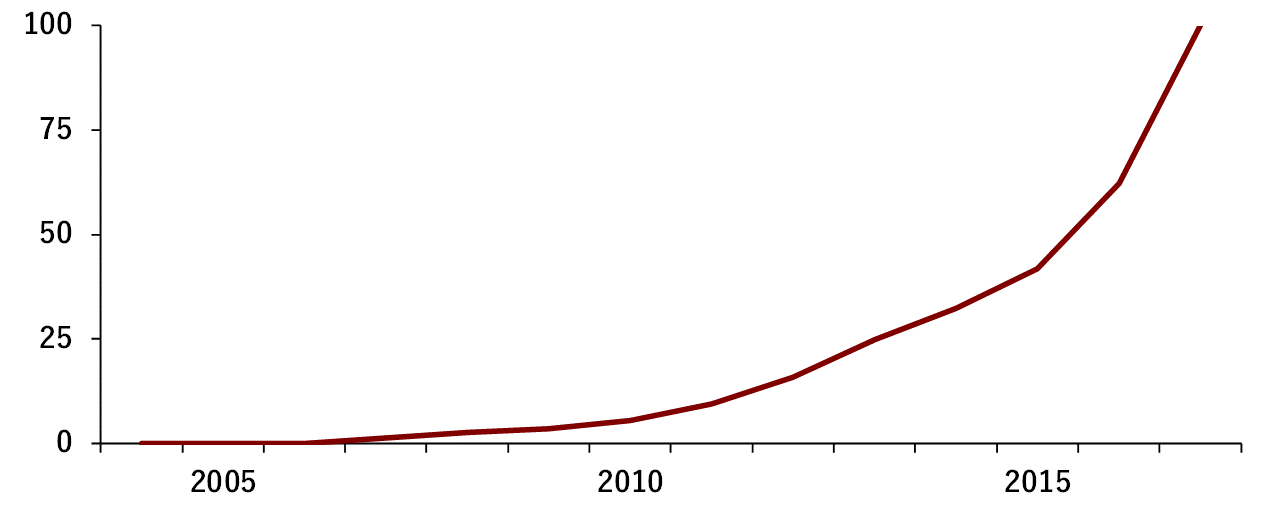

I have been interested in understanding the demand side of that equation, which does not get a lot of coverage. If you type “coworking” in Google Trends, you will find the level of public interest for this topic supports the idea that coworking will continue growing, fueled by an exponential demand trend.

Public interest in the word “coworking” through Google searches from 2004 to 2017 (Annualized index over a scale from 0 to 100)

But what exactly is the appeal of coworking? If the services offered by coworking spaces are at all indicative, small businesses must be looking for much more than cheap office amenities. Coworking spaces are increasingly competing on support services for entrepreneurs and startups. If you sign up, you’re no longer just getting a desk, access to meeting rooms, a printer, and coffee. You are also promised networking opportunities, training and mentorship, strategic advice, and even connections to potential investors.

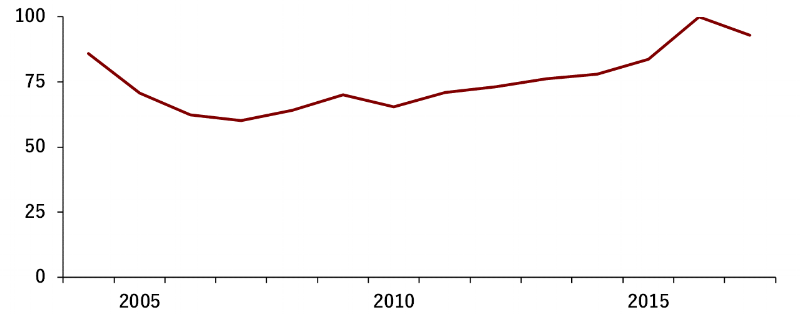

Here’s where things don’t fully add up though. If you use Google Trends again, this time to observe public interest in the words “incubator” and “accelerator” - two concepts that roughly encompass the spectrum of expanded services that coworking spaces are now focusing on - the picture looks quite different. The interest in “incubator” has been stagnant for years, and the interest in “accelerator” has been, well... steadily decelerating.

Public interest in the word “incubator” through Google searches from 2004 to 2017 (Annualized index over a scale from 0 to 100)

Public interest in the word “accelerator” through Google searches from 2004 to 2017 (Annualized index over a scale from 0 to 100)

Here’s another reason to question the appeal of coworking spaces’ expanded services. Google Trends also calculates the level of public interest in words by American state. So I plotted the level of interest in “coworking”, first against the proportion of startups in each State’s business landscape (graph on the left), and second against the average cost of renting space in each State’s main cities (graph on the right). This showed that public interest in coworking correlates much more with the cost of rent than with the number of startups. Put simply, this implies that startups are drawn to coworking spaces primarily because real estate is expensive, and not so much because they *are* startups and looking for startup support services.

Am I suggesting that the focus of coworking spaces on incubation and acceleration is all useless fluff? Not quite. The analysis I present here is far from complete. A lot more data is needed to deliver a definitive answer on the question. And even if my insight proved right, there are many reasons why offering incubation and acceleration services still makes a lot of sense for coworking spaces. Here are three I can think of:

1. It’s probably good marketing. Think of this analogy: if you had the choice between joining a gym with a steam room and one without, you might well choose the former, even if you ended up paying more and barely using that steam room. Your reason to do so might be the sense of sophistication that the steam room adds to the gym, or some optimism bias (“I’ll find the time”), or simply FOMO (“I can’t be the only entrepreneur going to a gym without a steam room”). The point I am making is that incubator and accelerator services might be to coworking spaces what steam rooms are to gyms.

2. Startups don’t know what they don’t know until they do. Securing cheap workspace might be many entrepreneurs’ sole objective when looking for coworking options. But once they join a coworking space, start developing a network of peers, and get familiar with the challenges and ways of entrepreneurship, they might well realize that they do need training, mentorship, or advice. From the point of view of coworking spaces, offering incubation and acceleration services then becomes a client-retention tactic.

3. When startups succeed, coworking spaces succeed. Coworking spaces thrive on success stories. Nothing draws more startups to a coworking space than a reputation for launching ventures towards funding and fame. It is therefore in a coworking space’s interest to assist its startups-in-residence. Put simply, incubator and accelerator services may just be the direct reflection of the fact that coworking spaces and startups need each other to succeed. Call it a win-win!

Do you have another perspective on coworking that you’d like to share? We’d love to hear from you - shoot us a note here!

References:

* Startup Density figures were obtained from The Kauffman Index

* Space rent costs are for 2016 and were obtained from the RentCafé® Blog