Depreciation /dəˌprēSHēˈāSH(ə)n/ noun

A reduction in the value of an asset with the passage of time, due in particular to wear and tear.

Depreciation is, quite simply, how much of an object’s value has been used up. This applies to physical objects (aka “tangible goods”) like buildings, equipment, and vehicles. It is used in both accounting and tax contexts

We have all experienced depreciation in our daily lives. Your brand new car loses some of its value once driven off the lot. The shirt that you never wore fetches only a fraction of its retail price on eBay. The more you drive your car or wear your shirt, the lower are their resale values.

But while you, as an individual, do not benefit from this loss, companies can use depreciation to lower their taxes. How? Companies are allowed to subtract depreciation from corporate profit before income tax is calculated. For small businesses this depreciation write-off can have a meaningful impact on tax liability.

Fortunately, you don’t need to check eBay or real estate listings to know the depreciation of your company assets. The IRS gives you a few methods to calculate it. Which method to use depends on a number of factors, and your accountant should help you navigate the murky waters of IRS code. In the meantime, here are two most ways to calculate depreciation:

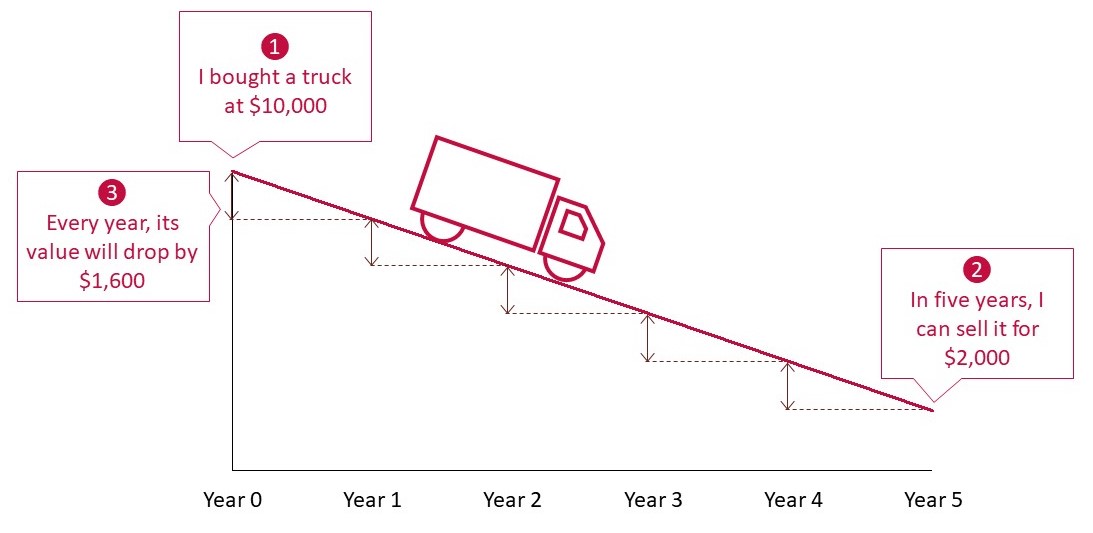

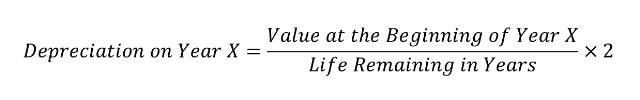

1. Straight-line depreciation

The “straight-line depreciation” method essentially says that the value of an asset drops by a fixed amount every year until it is scrapped. For each type of asset, the IRS specifies a “lifespan”, that is a standard number of years until the asset can be scrapped. With that, you can calculate your asset’s yearly depreciation:

For example, Let’s say you buy a truck for $10,000 and believe that at the end of its lifespan in 5 years, it would be worth a scrap value of $2,000, then your annual depreciation value will be ($10,000 - $2,000) / 5 = $1,600.

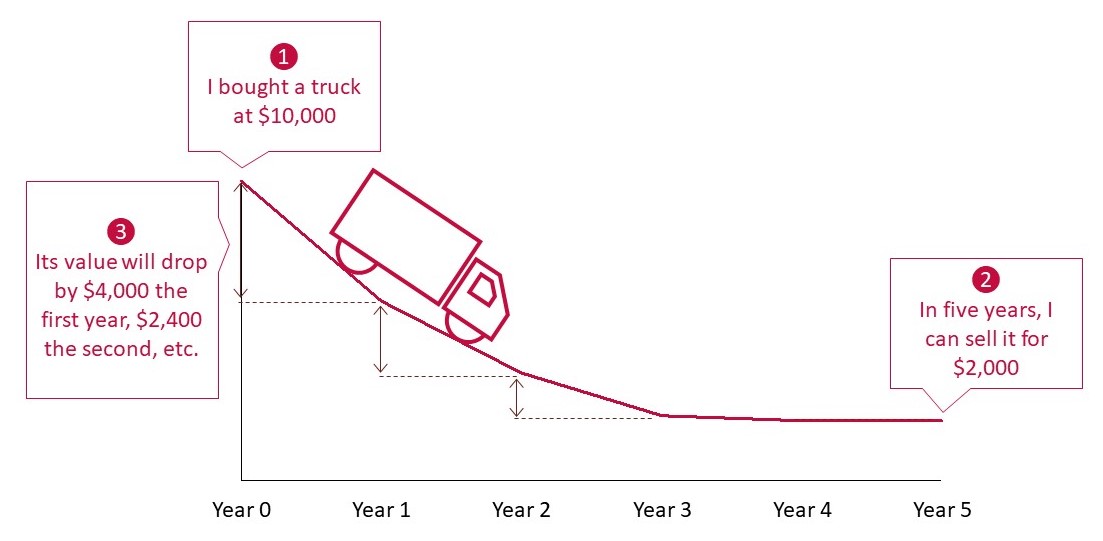

2. Double-declining balance

With “double-declining balance” method, an asset will depreciate most in its early years, and lesser and lesser as years go by. Companies will generally choose this method in an effort to minimize their taxes. Every year depreciation is recalculated this way:

Using our example of the $10,000 truck with a 5-year lifespan, the first year’s annual depreciation will be $10,000 / 5 years x 2 = $4,000. Thus, the value of the truck after only one year will have dropped to $6,000.

Either way you slice it, the depreciation principle is the same: how long the asset serves your needs and how that affects its resale value over time.